Artificial Intelligence (AI) is making waves across many industries, and personal finance is no exception. From automated wealth management to predictive analytics, AI is not just enhancing the efficiency of financial services but also democratizing investment opportunities. Let’s look at how AI is reshaping the investment landscape, offering innovative solutions that were once limited to only the wealthiest investors.

AI’s Role in Personal Finance and Investments

The traditional investment process has often been complex and inaccessible, especially for everyday individuals. However, AI is breaking these barriers, enabling personalized finance at scale. AI-powered systems are capable of processing vast amounts of data, helping investors make better-informed decisions in real-time. These tools analyze everything from market trends to personal spending habits, offering tailored recommendations that optimize financial strategies.

Machine learning models, a key subset of AI, are particularly useful in analyzing historical data to predict future market trends. These models can sift through thousands of data points in seconds, identifying patterns that human analysts may miss. By using predictive analytics, investors can stay ahead of market changes and make more accurate investment decisions.

Personalized Investment Strategies Powered by AI

One of the most exciting developments in AI for personal finance is the ability to create highly personalized investment strategies. Robo-advisors, which use AI to automate investment advice, have gained popularity in recent years. These platforms can assess an individual’s financial situation, goals, and risk tolerance, then create and manage a diversified investment portfolio on their behalf. By continually learning from new data, AI ensures that the strategies evolve with the market, optimizing for better returns.

This level of customization goes beyond what traditional financial advisors could offer, as AI algorithms can quickly adapt to changes in the economy, tax laws, or even shifts in personal financial status. In essence, AI gives everyday investors access to sophisticated, high-quality financial advice that was previously out of reach.

AI’s Impact on Portfolio Management

AI is also transforming portfolio management by enabling more efficient and dynamic decision-making. Financial institutions are increasingly using AI-driven systems to track and adjust portfolios automatically. For example, AI tools can optimize asset allocation based on market conditions or forecasted economic shifts. This proactive approach to portfolio management helps mitigate risks and ensure that investments remain aligned with the investor’s financial goals.

Furthermore, AI technologies are improving the accuracy of financial forecasting. They analyze news, financial reports, and social media to identify sentiment and predict how market events could impact specific assets. This allows investors to make more informed decisions, helping them avoid costly mistakes during volatile market conditions.

The Power of AI in Risk Management

Risk management is another area where AI has proven to be a game-changer. Traditional risk assessment methods often rely on historical data and broad market assumptions. However, AI-driven tools can analyze a broader spectrum of variables, including real-time market sentiment, geopolitical developments, and even weather patterns that could impact investments.

Machine learning algorithms can evaluate how different factors interact to influence an investor’s portfolio, providing insights into potential risks that traditional methods may overlook. For example, AI tools can forecast the impact of a major policy change on a particular sector or identify which assets are most susceptible to market downturns.

A Democratization of Finance

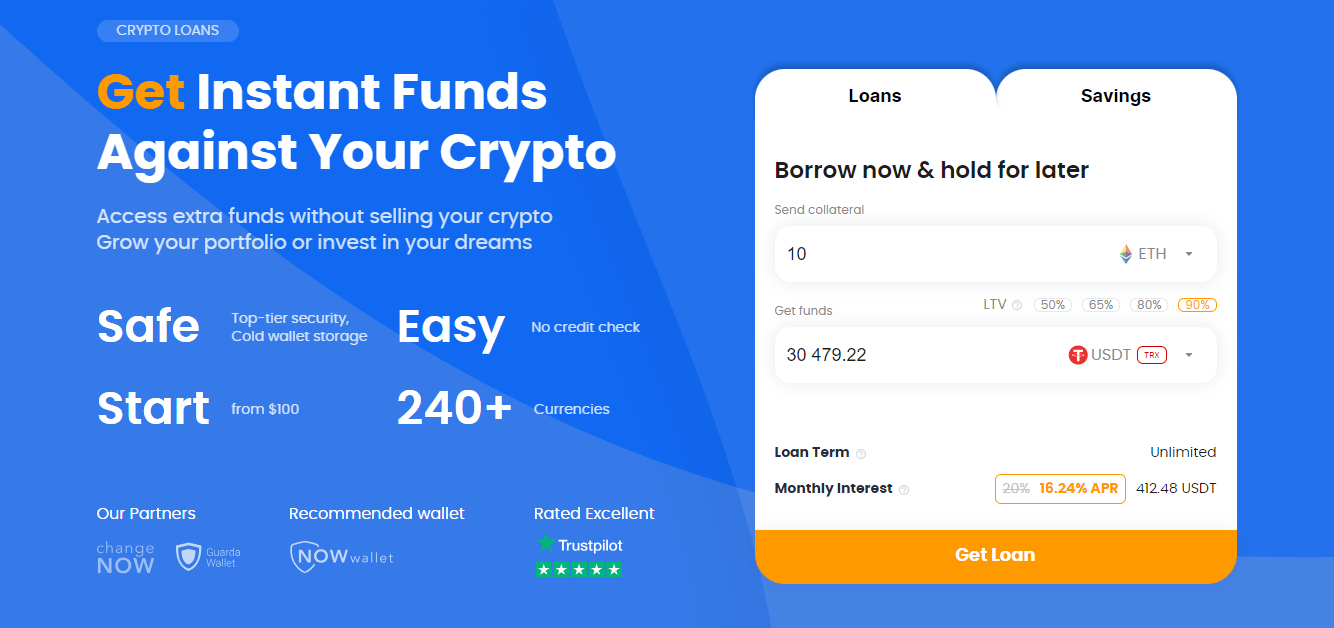

What sets AI apart in personal finance is its ability to democratize access to sophisticated financial tools. AI platforms are accessible to anyone with an internet connection, offering advanced investment strategies without the need for high minimum balances or expert financial knowledge. This is a game-changer for retail investors who previously had limited access to institutional-grade financial advice.

By offering tools that are easy to use and affordable, AI is helping a new generation of investors take control of their financial futures. These innovations are lowering the barriers to entry, allowing more people to benefit from the wealth-building potential of smart investing.

Challenges and Ethical Considerations

While the rise of AI in personal finance brings numerous benefits, there are also challenges and ethical considerations. One of the main concerns is the potential for AI systems to make biased decisions based on incomplete or skewed data. To mitigate these risks, it is crucial for AI models to be transparent and constantly updated with diverse data sources.

Additionally, as AI continues to automate key aspects of personal finance, there are concerns about data privacy and security. Since AI systems require vast amounts of personal and financial data, ensuring that this information is protected is essential to maintaining trust and confidence in AI-powered financial tools.

Conclusion: AI’s Bright Future in Personal Finance

AI is undoubtedly reshaping the future of personal finance and investment. By enhancing decision-making, personalizing strategies, and democratizing access to sophisticated financial tools, AI is making investing more efficient, accessible, and profitable. As technology continues to evolve, AI will likely play an even more significant role in how we manage our finances and investments, empowering individuals to take control of their financial futures.

FAQs

1. What is AI-powered personal finance?

AI-powered personal finance refers to the use of artificial intelligence and machine learning to automate, analyze, and optimize financial decisions, from investment strategies to budgeting and risk management.

2. How does AI improve investment decisions?

AI improves investment decisions by analyzing large volumes of data, detecting patterns, and providing personalized recommendations tailored to an investor’s financial goals, risk tolerance, and market trends.

3. Are AI tools for personal finance accessible?

Yes, AI tools for personal finance are increasingly accessible to individuals through platforms like robo-advisors, which allow anyone to benefit from advanced investment strategies without requiring expert knowledge or large capital.

AI is reshaping finance by empowering investors with tools that were once out of reach, making smart investing simpler and more accessible than ever.