The cryptocurrency market is always full of exciting opportunities, and $STORJ/USDT is currently one to watch. As of now, $STORJ is priced at $0.3819 on Binance, showing potential for a bullish breakout. With key targets ahead and important technical indicators to track, it’s time to dive into the details to see where $STORJ might be headed.

If you’re already holding $STORJ or considering adding it to your portfolio, here’s a comprehensive look at the key levels, trends, and indicators to help you make informed decisions.

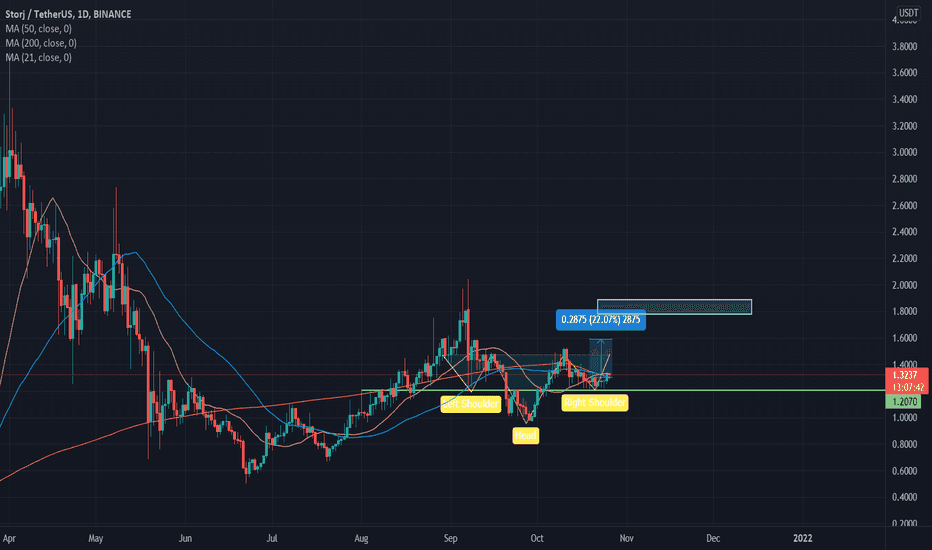

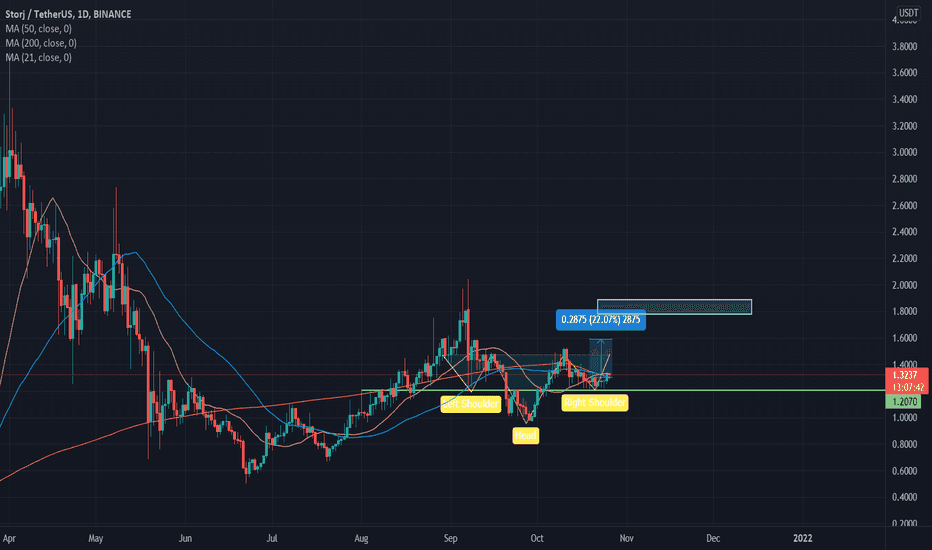

Key Levels to Watch

When it comes to technical analysis, identifying key price levels is essential for understanding potential price movements. Let’s break down the most important levels for $STORJ/USDT.

- 🎯 Target 1: $0.3950

The first significant resistance level to watch is $0.3950. This price point represents the first obstacle for $STORJ to overcome if we want to see any real bullish momentum. Breaking above this level could signal the start of an upward trend, attracting more traders and creating excitement in the market.

A close above $0.3950 would be a strong signal that buyers are gaining control. However, as with any resistance level, we may see price rejection if the market lacks enough volume and strength to push through.

- 🎯 Target 2: $0.4200

Once $0.3950 is surpassed, the next target to monitor is $0.4200. This medium-term target represents a continuation of bullish sentiment and would suggest that $STORJ has established a new, higher trading range.

Hitting $0.4200 could indicate that buyers have taken control and are driving the price upward, pushing the asset toward new highs. A breakout here would likely attract more investors as confidence builds in the strength of the trend.

- 🎯 Target 3: $0.4500

For the long-term outlook, the final target we’re watching is $0.4500. This level represents a key psychological barrier, and significant price action is expected in this zone.

Reaching this price would solidify the bullish case for $STORJ and may even attract institutional interest. However, it’s important to remain cautious here as strong resistance could also trigger profit-taking, leading to temporary retracement or consolidation before another leg up.

Indicators to Note

Alongside key price levels, a few important technical indicators can offer further insights into potential market movements.

- SAR (Stop and Reverse):

The SAR (0.02, 0.2) is currently set at $0.3764, indicating a nearby support level. This indicator suggests that if the price drops below this level, we may see a retracement. However, as long as $STORJ remains above the SAR, we can expect the bullish trend to continue.

The SAR is a useful tool for traders who want to ride trends and adjust their positions accordingly. In this case, keeping the price above $0.3764 will be key for sustaining upward momentum.

- 24h High/Low:

The 24-hour high is $0.3825, while the 24-hour low sits at $0.3552. These intraday levels are critical for short-term traders who are looking to catch quick moves. A break above the 24-hour high could generate short-term bullish signals, while a drop below the low might indicate bearish pressure building.

Watching how $STORJ behaves around these levels can give traders insight into where the price might be headed over the next trading sessions.

Current Market Sentiment

As of now, $STORJ appears to be moving in a bullish direction. The price is trading close to its 24-hour high, indicating that buyers are maintaining control. However, the relatively tight price range between $0.3819 and the intraday high of $0.3825 suggests that the market may be waiting for a strong catalyst to push the price higher.

Volume is always a crucial factor in determining whether a breakout is imminent or if we’re likely to see consolidation. Traders should keep an eye on volume spikes around the key resistance levels—particularly at $0.3950. If we see volume increase as the price approaches this level, it could be a sign that the market is preparing for a breakout.

Conclusion: Are We Ready for a Breakout?

So, are we about to witness a breakout with $STORJ/USDT? The technicals suggest that the possibility is certainly there, but the key will be how the price interacts with resistance levels. $0.3950 is the first target to watch, and a successful breakout here could open the doors to further gains at $0.4200 and beyond.

The SAR indicator points to solid support at $0.3764, so as long as the price holds above this level, the bullish case remains intact. However, if we see price rejection at key resistance levels or a drop below support, the market could take a step back for consolidation.

Keep a close eye on volume and market sentiment, as these will play significant roles in determining whether $STORJ is ready to climb higher. If the trend continues, $STORJ could very well reach the $0.4500 target, bringing long-term gains to patient investors.

FAQs

1. What is the significance of the $0.3950 level for $STORJ?

The $0.3950 level is a key resistance point. A breakout above this price could signal the start of a bullish trend, attracting more buyers into the market and pushing the price higher.

2. How does the SAR indicator help in trading $STORJ?

The SAR (Stop and Reverse) indicator helps identify potential trend reversals. For $STORJ, the SAR is currently set at $0.3764, meaning that if the price drops below this level, we could see a trend reversal or retracement.

3. What are the potential price targets for $STORJ?

If $STORJ breaks above $0.3950, the next targets to watch are $0.4200 for medium-term gains and $0.4500 for long-term bullish action. Each level represents a potential point for profit-taking or further price acceleration.