In the ever-evolving world of cryptocurrencies, few assets have managed to capture the attention of traders and investors like $STMX. Over the past few weeks, $STMX has experienced a remarkable surge, growing nearly five times in value and moving from the green zone 🟩 to the orange zone 🟧. After hitting the orange signal 🟠, where many took profits 💰, the asset is now consolidating, testing the yellow zone multiple times and waiting for an opportunity to break through.

A Closer Look at $STMX’s Meteoric Rise

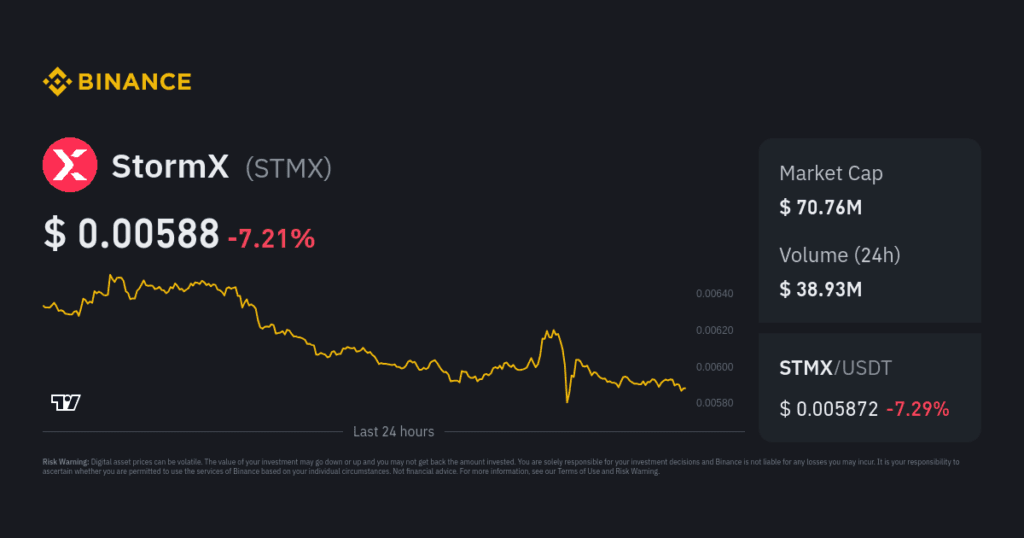

$STMX, the native token of StormX, has been on a tear lately. The token’s impressive run began when it broke out of the green zone, a period marked by accumulation and steady growth. As the momentum picked up, $STMX entered the orange zone, where it saw a significant increase in trading volume and price action, leading to substantial profits for those who timed their entries and exits well.

The green zone typically represents a period of accumulation, where savvy investors load up on tokens in anticipation of a bullish move. As the token gained traction, it moved into the orange zone, signaling a more aggressive phase of growth. During this time, the asset’s price soared nearly fivefold, attracting attention from both retail and institutional investors.

Profit-Taking in the Orange Zone

As the token reached the orange zone, many traders and investors saw it as an opportunity to take profits. The orange signal 🟠 often marks a crucial point in a token’s price journey, where the risk-to-reward ratio starts to balance out, and profit-taking becomes a smart move. For those who were able to enter during the green zone and exit in the orange zone, the gains were significant.

However, the orange zone is also a critical juncture where the market decides the next move. After the initial surge, $STMX has entered a consolidation phase, a common occurrence after such rapid price appreciation. Consolidation allows the market to catch its breath, with traders and investors watching closely for signs of the next big move.

The Current Consolidation Phase: What Does It Mean?

Now that $STMX is consolidating, what should you expect? Consolidation periods are characterized by reduced volatility and narrower price movements. For $STMX, this means the token is hovering around a particular price range, testing the yellow zone repeatedly without making a decisive move.

The yellow zone represents a level of resistance that $STMX has attempted to break through multiple times. Each test of this resistance strengthens it, but it also increases the likelihood of a breakout. Traders are keenly watching for signs of increased buying pressure or any catalyst that could push $STMX beyond the yellow zone.

What’s Next for $STMX?

The big question on everyone’s mind is: Will $STMX break through the yellow zone and continue its upward trajectory, or will it face further resistance and potentially retrace?

- Potential Breakout:

If $STMX manages to break through the yellow zone, it could signal the start of a new bullish phase. Such a breakout would likely attract more buyers, leading to another surge in price. The key is to watch for volume spikes and any significant news or developments related to StormX that could serve as a catalyst. - Continued Consolidation:

On the other hand, $STMX could continue to consolidate within the current range. While this might seem uneventful, it’s an essential phase where the market decides the next direction. For long-term holders, consolidation can be an opportunity to accumulate more tokens at lower prices before the next move. - Possible Retracement:

There’s always the possibility that $STMX could face a retracement, especially if it fails to break through the yellow zone after multiple attempts. A retracement would see the price pull back to lower support levels, providing another potential entry point for investors looking to capitalize on the next wave.

Future Prospects

$STMX’s journey from the green to the orange zone has been nothing short of impressive. With nearly 5x growth and a significant amount of profit-taking, the token is now in a critical consolidation phase. Whether $STMX will break through the yellow zone or continue to trade within its current range remains to be seen. For now, it’s essential to stay informed, keep an eye on the charts, and be ready to act when the next opportunity arises. As with any cryptocurrency, the road ahead is unpredictable, but that’s part of the thrill of the crypto market.

FAQs

1. What is the significance of the yellow zone for $STMX?

The yellow zone represents a level of resistance that $STMX has tested multiple times. Breaking through this zone could signal the start of a new bullish phase.

2. Is it a good time to invest in $STMX during the consolidation phase?

Investing during a consolidation phase can be strategic, especially if you believe in the long-term potential of the token. However, it’s essential to be aware of the risks and monitor the market closely.

3. What should I watch for to predict $STMX’s next move?

Keep an eye on trading volume, news related to StormX, and any significant price movements that indicate increased buying pressure or a potential breakout from the yellow zone.