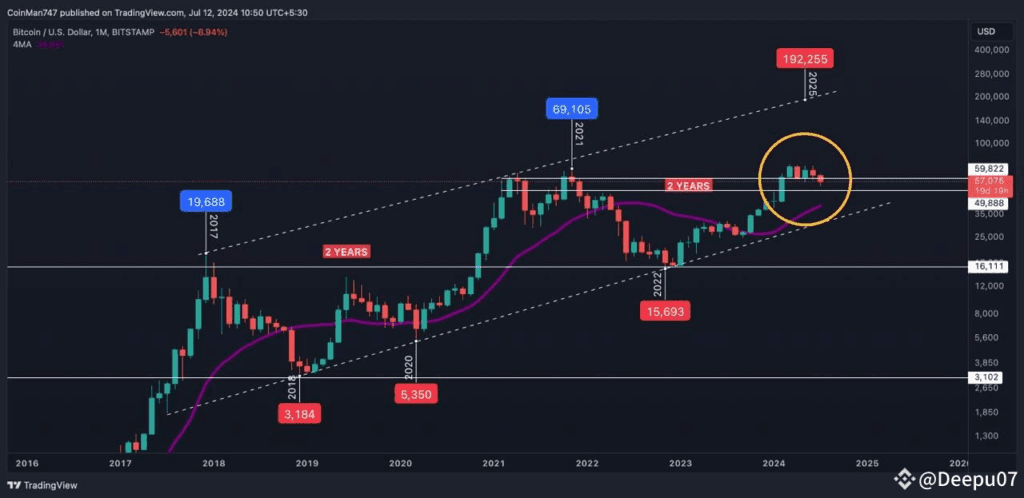

If you’ve been following the crypto market closely, you might have noticed something interesting on Bitcoin’s monthly chart. There’s a sense of déjà vu as Bitcoin’s price action seems to mirror last year’s pattern. Back in October 2023, Bitcoin experienced a period of sideways movement, frustrating both traders and investors alike. But that sideways movement didn’t last forever—Bitcoin eventually broke out with a strong upward surge. Now, in 2024, Bitcoin’s chart is showing similar signs, leading many to wonder: is another big move on the horizon?

Let’s look into what’s happening, why Bitcoin’s Monthly chart looks familiar, and whether we might see history repeat itself.

The Familiar Sideways Movement

When it comes to Bitcoin, volatility is almost a given. This year, however, the market has seen a more prolonged period of consolidation. Since mid-summer 2024, Bitcoin has been moving in a fairly narrow price range, frustrating traders who thrive on volatility. Historically, such long periods of sideways trading have been precursors to major moves. And if we look at the same period last year, a similar pattern played out.

In 2023, Bitcoin experienced a sideways pattern from August through October. Market sentiment was cautious, with no clear indicators suggesting a major move up or down. Then came the breakout: by November, Bitcoin had surged significantly, making double-digit gains in a matter of weeks. The question on everyone’s mind now is whether this year will follow the same path.

Why This Year Feels Similar

Bitcoin’s current price action is eerily reminiscent of last year, but it’s not just about the charts. Several macroeconomic and market factors are contributing to this sense of familiarity:

- Institutional Interest Is Still High

Just like in 2023, institutional interest in Bitcoin remains strong. Companies and large funds continue to explore Bitcoin as a hedge against inflation and economic uncertainty. The upcoming halving event in 2024 has also created long-term bullish sentiment. - Market Sentiment Is Cautiously Optimistic

Crypto sentiment seems cautiously optimistic. While the market hasn’t seen the wild speculation of past bull runs, there’s still a steady stream of positive news. Bitcoin ETFs are making progress in several countries, adoption is expanding globally, and major companies are integrating Bitcoin into their financial models. This slow burn of positive news is reminiscent of last year’s gradual build-up to the breakout. - The Broader Economy Is in a Similar State

In both 2023 and 2024, global economic uncertainty plays a role in Bitcoin’s price action. Last year, inflation fears and rate hikes dominated the headlines, driving some investors toward Bitcoin as a hedge. This year, those fears have shifted slightly, but geopolitical tensions, debt concerns, and a cooling tech sector are still influencing investment decisions.

Could a Big Move Be Coming?

Given the similarities between Bitcoin’s 2023 and 2024 monthly charts, the natural question is: will history repeat itself? While no one can predict the future with certainty, there are reasons to believe that a major move could be in the works.

- The Technical Picture

On the technical side, Bitcoin’s current monthly chart shows several signs that a breakout could be near. It’s forming a pattern similar to last year’s consolidation phase, complete with steady support levels and declining volatility. Traders will be watching for a key breakout above resistance levels—if Bitcoin can clear those levels with strong volume, we could see a rapid upward move, just like last year. - Market Momentum Is Building

Aside from the technicals, momentum is slowly building in the crypto market. Altcoins have seen modest gains, but Bitcoin dominance has stayed strong, indicating that traders are looking to Bitcoin for leadership. When Bitcoin monthly chart begins to move, the entire crypto market tends to follow. With the upcoming Bitcoin halving event in 2024 on the horizon, many believe that Bitcoin’s next bull run could be even more dramatic than last year’s. - The Halving Narrative

One factor that sets 2024 apart from 2023 is the looming Bitcoin halving. Scheduled for next year, this event will reduce the supply of newly minted Bitcoin, historically leading to price increases. Although the halving hasn’t happened yet, many traders are positioning themselves in anticipation of a pre-halving rally. This “buy the rumor, sell the news” mentality could help fuel a breakout in the coming months.

What Could Derail a Breakout?

While optimism is high, it’s important to consider potential risks. The crypto market is notoriously unpredictable, and a number of factors could prevent Bitcoin monthly chart from breaking out:

- Regulatory Crackdowns: The threat of regulation always looms over the crypto market. Any sudden, unfavorable regulatory news could stifle momentum.

- Macroeconomic Shifts: A major shift in the broader economy—such as a sudden improvement in inflation numbers or a strong recovery in traditional markets—could draw attention away from Bitcoin.

- Market Manipulation: Large holders, or “whales,” could potentially manipulate the market, pushing Bitcoin monthly chart in either direction before a breakout occurs.

Despite these risks, the overall sentiment remains positive, and many traders are keeping a close eye on the charts, waiting for that all-important breakout signal.

Conclusion: Are We Heading Toward Another Bitcoin Monthly Chart Rally?

The similarities between Bitcoin’s 2023 and 2024 monthly charts are hard to ignore. With Bitcoin showing signs of consolidation and technical indicators pointing toward a possible breakout, many believe that a major move could be just around the corner. Add in the anticipation surrounding the 2024 halving event, and the case for a significant Bitcoin rally becomes even stronger.

While no one can predict with certainty whether Bitcoin will repeat its 2023 performance, the conditions are in place for a potential surge. Traders and investors should keep a close watch on resistance levels, trading volume, and market sentiment to get a clearer picture of where Bitcoin might head next.

FAQs

1. What is Bitcoin’s current price action showing?

Bitcoin is currently in a sideways trading pattern, similar to what we saw last year. This consolidation could be a sign of an upcoming breakout.

2. Why do people think Bitcoin might rally soon?

Many believe that Bitcoin’s monthly chart is showing similarities to last year’s pattern, where a breakout followed a period of sideways movement. The upcoming halving event in 2024 is also fueling optimism.

3. What are the risks to Bitcoin’s price surge?

Regulatory crackdowns, macroeconomic shifts, or market manipulation could derail a potential monthly chart breakout. However, the overall sentiment remains cautiously optimistic.