Table of Contents

Bitcoin at $97K: What’s Driving the Market?

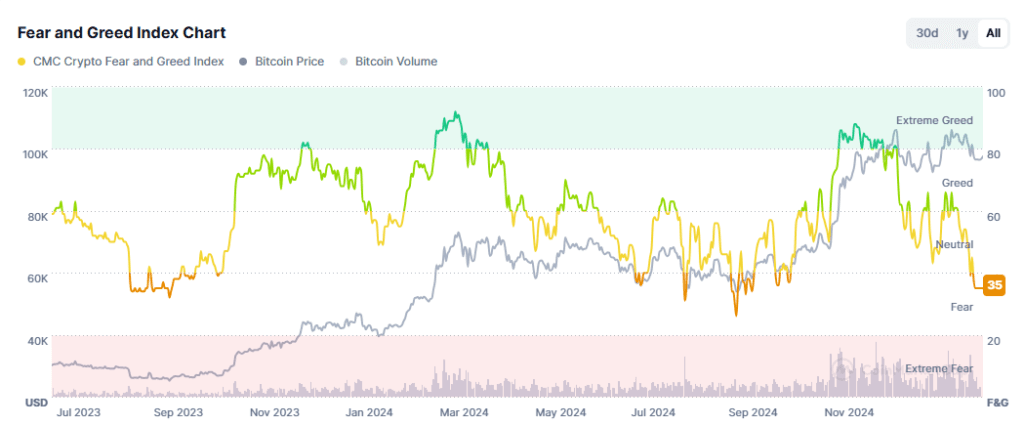

Bitcoin is on the move again, trading at $97,608.01, up 1.41% in the past 24 hours. Ethereum has also climbed, gaining 1.95% to reach $2,691.82. But despite these price increases, market sentiment remains cautious, reflected in the Fear and Greed Index, which sits at 35 (Fear).

With ETF inflows rising and key economic events ahead, the next few days could be crucial for crypto investors. Will Bitcoin hold its gains, or is another pullback on the horizon? Let’s break down the latest market trends.

Bitcoin at $97K: Bullish or Bearish Market Outlook?

The total cryptocurrency market cap currently stands at $3.2 trillion, down from its recent peak of $3.8 trillion. This pullback suggests a cooling-off period after a strong rally.

However, trading volume remains high at $114.9 billion, showing that traders are still active. Bitcoin dominance is at 60.5%, meaning BTC continues to be the market leader, while altcoins struggle to gain traction. The Altcoin Season Index at 36 confirms that Bitcoin is driving the market, not altcoins.

Fear and Greed Index: A Sign of Trouble?

The Fear and Greed Index is a popular tool for gauging market sentiment. Right now, it’s flashing fear at 35, down from 43 last month.

Sentiment Over Time:

- Today: 35 (Fear)

- Yesterday: 35 (Fear)

- Last Week: 39 (Fear)

- Last Month: 43 (Neutral)

The shift from neutral to fear signals growing caution among investors. Historically, fear-driven markets have often created buying opportunities for long-term investors, but short-term volatility remains a risk.

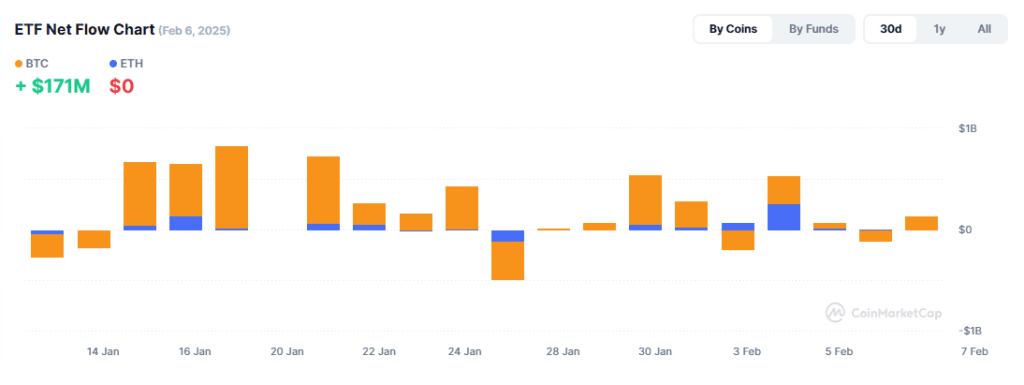

Bitcoin ETFs: Institutional Demand Remains Strong

Despite market uncertainty, institutions are still betting on Bitcoin. On February 6, 2025, Bitcoin ETF inflows hit $171.3 million, indicating sustained investor confidence.

ETF inflows are a key metric for institutional sentiment. If this demand continues, it could provide support for Bitcoin’s next leg up. However, broader economic trends and Federal Reserve policy decisions will play a major role in shaping short-term price action.

Key Economic Events That Could Impact Bitcoin at $97K

This week brings several major economic reports and events that could influence Bitcoin’s price.

Tuesday, February 11: Fed Chair Powell’s Testimony

- Time: 10:00 AM ET

- Potential Market Impact:

- A hawkish stance (favoring higher interest rates) could weigh on Bitcoin.

- A dovish tone (hinting at rate cuts) could spark a short-term rally.

Wednesday, February 12: Inflation Data Release

- 08:30 AM ET:

- Core Inflation Rate MoM: Forecast: 0.3% (Previous: 0.2%)

- Inflation Rate YoY: Forecast: 2.9% (Previous: 2.9%)

- Market Impact:

- Higher-than-expected inflation could lead to extended rate hikes, pressuring BTC and ETH.

- Lower inflation data may signal a Fed policy shift, boosting crypto markets.

Thursday, February 13: Producer Price Index (PPI) Report

- 08:30 AM ET: Forecast: 0.3% (Previous: 0.2%)

- Impact: If PPI comes in higher than expected, it could raise inflation concerns, increasing the likelihood of Fed tightening—a potential downside risk for Bitcoin.

Friday, February 14: Retail Sales Report

- 08:30 AM ET: Forecast: -0.1% (Previous: 0.4%)

- Market Impact:

- Weak retail data could increase speculation of Fed rate cuts, potentially boosting Bitcoin.

- Strong sales numbers might push bond yields higher, which could negatively impact risk assets like crypto.

Crypto Derivatives & Market Volatility

The derivatives market remains a key factor in Bitcoin’s price movements. High leverage positions can trigger sharp volatility, so traders should stay alert.

- Perpetual Open Interest: $619.25 billion

- Futures Open Interest: $4.79 billion

- Bitcoin Implied Volatility: 55.17

- Ethereum Implied Volatility: 73.32

Notably, Ethereum’s implied volatility is higher than Bitcoin’s, indicating more speculative activity in ETH, which could lead to bigger price swings.

Bitcoin Price Outlook: What’s Next?

Right now, Bitcoin appears to be in a consolidation phase, with key economic data ahead that could trigger price swings.

📊 Key Takeaways:

✅ Bitcoin remains dominant at 60.5% market share

✅ ETF inflows show strong institutional interest

✅ Fear and Greed Index signals market uncertainty

✅ Upcoming economic events will influence short-term trends

With Bitcoin at $97K, traders should closely watch upcoming inflation data and ETF flows to gauge Bitcoin’s next move.

Final Thoughts: Can Bitcoin Hold Above $97K?

Bitcoin is at a crucial inflection point. Institutional demand remains strong, but macroeconomic factors will likely determine whether BTC can maintain its current price or face another correction.

🚀 Looking Ahead:

- ETF inflows could help stabilize Bitcoin’s price

- Federal Reserve decisions will drive short-term sentiment

- Altcoins remain weak, but volatility could create opportunities

Read more: Here