The cryptocurrency world is brimming with opportunities for generating continuous income, whether you’re a seasoned trader or just starting out. With digital assets gaining popularity, more people are looking for ways to tap into this burgeoning financial ecosystem. If you’re wondering how to make consistent income from crypto, here’s a practical guide to help you explore both active and passive income strategies.

Active Income Methods For Making Money In Cryptocurrency

Active income in cryptocurrency typically involves more hands-on management and decision-making. Here are some popular methods:

**1. Day Trading

Day trading involves buying and selling cryptocurrencies within the same day to capitalize on short-term price movements. This strategy requires a solid understanding of market trends, technical analysis, and risk management. Traders look for patterns and signals to make informed decisions and aim to profit from the volatility of crypto prices.

Pros:

- Potential for high returns if done correctly.

- Flexibility to trade from anywhere with an internet connection.

Cons:

- Requires significant time and effort to monitor the markets.

- High risk and potential for losses if market conditions are unfavorable.

**2. Swing Trading

Swing trading focuses on capturing price swings over a period of days or weeks. Traders identify entry and exit points based on technical indicators and market trends. Unlike day trading, swing trading involves holding positions for a longer duration, which can be less stressful but still requires active monitoring.

Pros:

- Less time-consuming than day trading.

- Can benefit from both short-term and medium-term price movements.

Cons:

- Market volatility can still lead to losses.

- Requires a good understanding of technical analysis.

**3. Staking

Staking involves participating in a blockchain network’s proof-of-stake (PoS) mechanism. By locking up a certain amount of cryptocurrency in a staking wallet, you help secure the network and validate transactions. In return, you earn rewards in the form of additional cryptocurrency.

Pros:

- Provides a steady stream of rewards.

- Supports the security and functionality of blockchain networks.

Cons:

- Funds are locked up and not easily accessible.

- Rewards can vary based on network performance and staking conditions.

Passive Income Methods For Making Money In Cryptocurrency

For those who prefer a more hands-off approach, passive income strategies can be a great way to generate continuous revenue from crypto assets. Here are some popular passive methods:

**1. Yield Farming

Yield farming involves providing liquidity to decentralized finance (DeFi) platforms in exchange for interest or rewards. By depositing your cryptocurrency into a liquidity pool, you earn yields based on the platform’s rates and your contribution.

Pros:

- Potential for high returns depending on the platform and asset.

- Allows you to earn income from assets that would otherwise be idle.

Cons:

- Involves risks such as impermanent loss and smart contract vulnerabilities.

- Returns can be variable and depend on the platform’s performance.

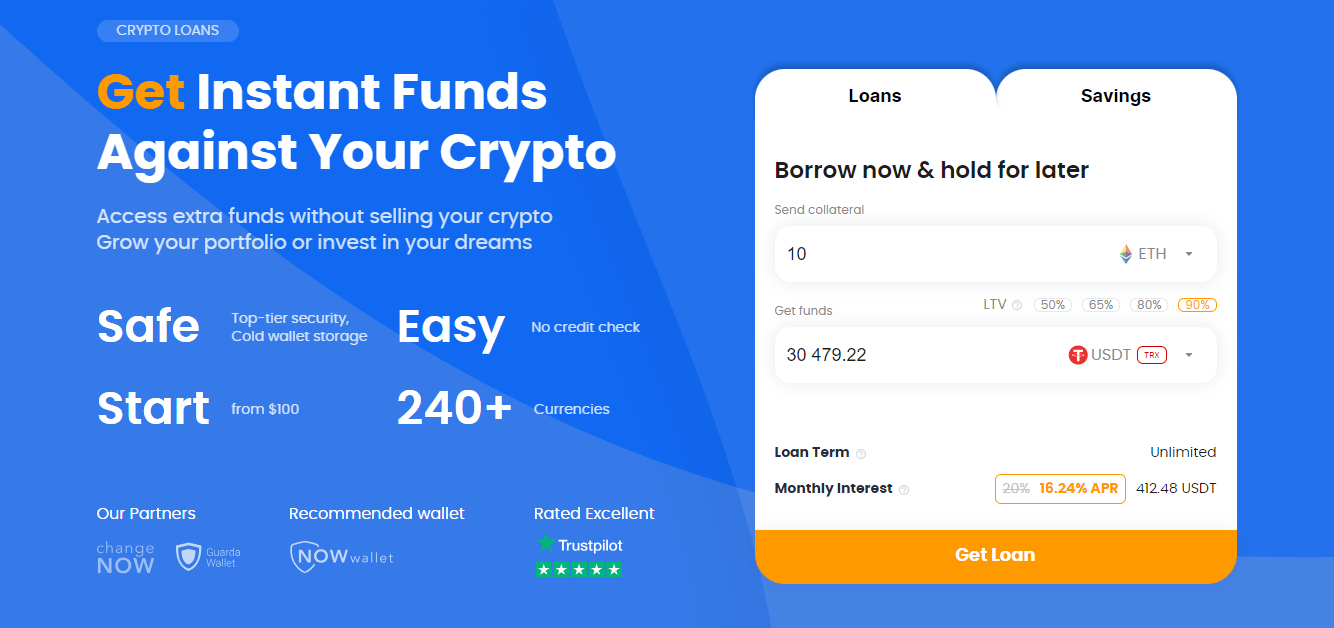

**2. Crypto Lending

Crypto lending platforms allow you to lend your cryptocurrency to other users in exchange for interest payments. These platforms act as intermediaries, matching lenders with borrowers. Your crypto earns interest over time, providing a steady income stream.

Pros:

- Provides regular interest payments.

- Relatively easy to get started with various lending platforms available.

Cons:

- Risk of borrower default and platform security issues.

- Interest rates can vary based on market conditions and platform policies.

**3. Dividend-Paying Tokens

Some cryptocurrencies and DeFi tokens offer dividends or revenue-sharing mechanisms to holders. By holding these tokens, you receive periodic payouts based on the project’s profits or revenue.

Pros:

- Passive income from holding tokens.

- Can benefit from the success and growth of the underlying project.

Cons:

- Dividend payouts can be unpredictable and depend on project performance.

- Token value can fluctuate, impacting overall returns.

Summary

The cryptocurrency world offers diverse opportunities for generating continuous income, whether through active methods like trading and staking or passive strategies like yield farming and lending. Each approach has its own set of benefits and risks, so it’s essential to choose methods that align with your risk tolerance, time commitment, and investment goals. By understanding and leveraging these strategies, you can tap into the potential of the crypto ecosystem and build a steady stream of income.

FAQs

1. How can I start day trading cryptocurrencies? To start day trading, you’ll need a reliable exchange, a good understanding of technical analysis, and a strategy for managing risk. Practice with small amounts or use a demo account to build your skills before committing significant funds.

2. What are the risks associated with yield farming? Yield farming carries risks such as impermanent loss, where the value of your assets can change relative to holding them. There’s also the risk of smart contract vulnerabilities and platform failures. It’s important to research and choose reputable platforms.

3. How do I choose a crypto lending platform? When selecting a crypto lending platform, consider factors such as interest rates, borrower vetting processes, platform security, and user reviews. Make sure the platform is reputable and has a track record of reliable performance.