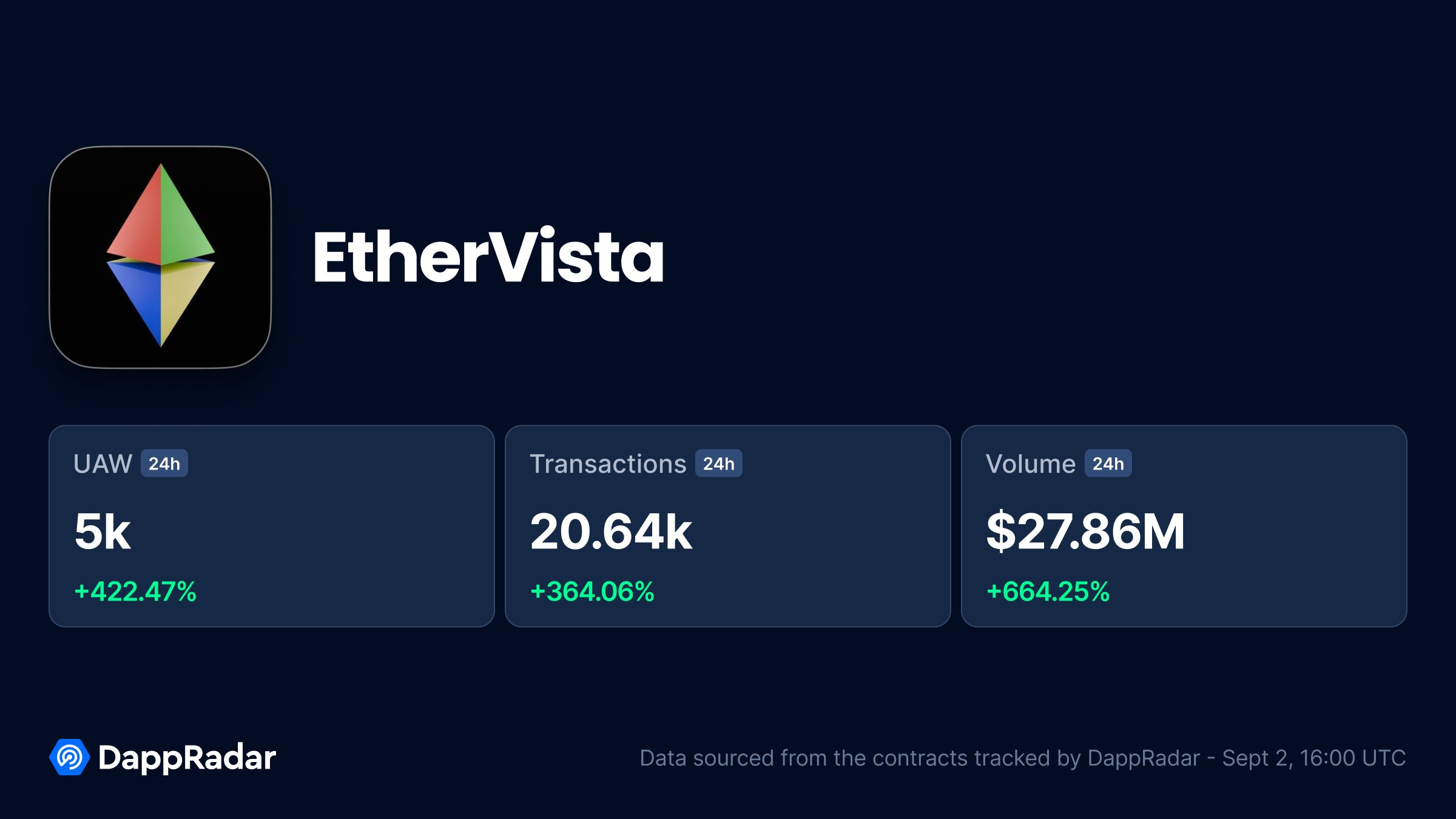

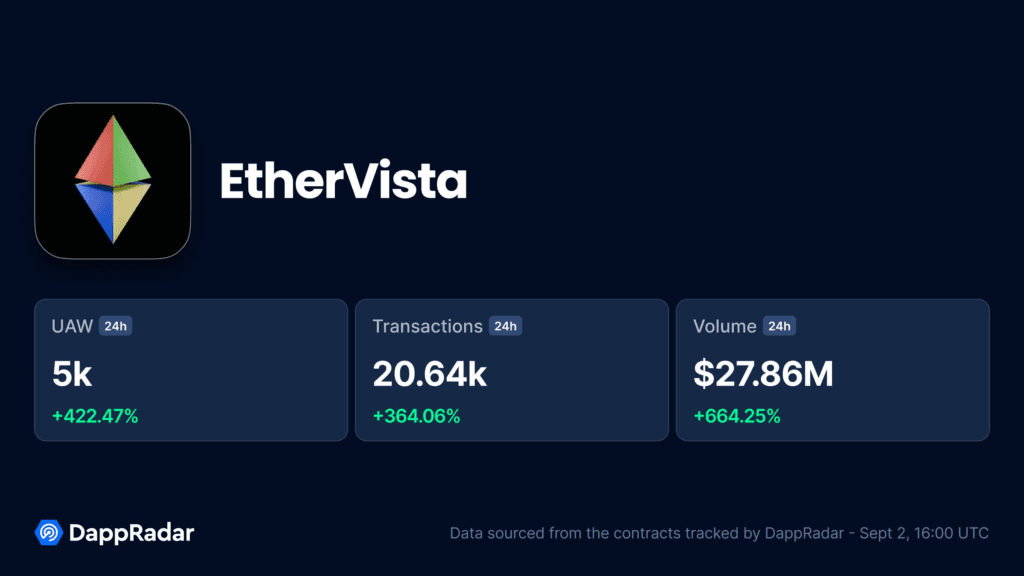

In the ever-volatile world of cryptocurrencies, the latest buzz is around Ethervista, a clone of Ethereum developed by #Pumpandfun. Ethervista has made headlines for its staggering consumption of gas fees, burning through a whopping 150 $ETH in just the past 24 hours. This sudden spike in gas fees has left the crypto community both intrigued and suspicious. Is Ethervista just the latest hot token, or is there something more going on behind the scenes? Let’s dive into the details.

Ethervista: The Gas Guzzler

Gas fees on the Ethereum network are nothing new, but the rate at which Ethervista is consuming gas is turning heads. For those unfamiliar, gas fees are the costs required to perform transactions on the Ethereum network. These fees are paid in $ETH and vary depending on the complexity of the transaction and the network’s congestion.

Ethervista has been a gas guzzler, consuming 150 $ETH in gas fees over a 24-hour period. To put that in perspective, that’s thousands of dollars spent just to process transactions on the network. While high gas fees are common during periods of heavy activity, Ethervista’s sudden spike has raised eyebrows across the crypto community.

The Story Behind VISTA

Ethervista’s story doesn’t start with gas fees; it starts with its first token, VISTA. When VISTA was launched, it experienced a meteoric rise, surging over 15x in value. This kind of explosive growth is the stuff of dreams for crypto investors, but in the case of VISTA, it appears there might be more to the story.

It turns out that the biggest and third-biggest wallets holding VISTA are controlled by the same entity. This individual bought a substantial amount of VISTA on September 1st and has been strategically selling off portions of it, raking in huge profits along the way. The realization that a single entity controls such a significant portion of VISTA has led to suspicions of market manipulation.

Market Manipulation or Smart Trading?

So, what’s really going on with Ethervista and VISTA? Is this a case of market manipulation, or is it just a savvy trader capitalizing on market conditions?

In the crypto world, it’s not uncommon for large holders (often referred to as “whales”) to have a significant influence on the market. When one individual or group holds a large amount of a token, they can cause price fluctuations simply by buying or selling in large quantities. This seems to be the case with VISTA, where the same entity has been both accumulating and offloading the token to maximize profits.

This kind of activity can lead to what’s known as a “pump and dump” scheme, where the price of a token is artificially inflated (pumped) by coordinated buying, only for the holders to sell off their shares at a profit, causing the price to crash (dump). While there’s no definitive proof that this is what’s happening with VISTA, the concentration of tokens in a few wallets certainly raises concerns.

The Impact on the Community

For everyday investors, the situation with Ethervista and VISTA is a cautionary tale. While some people are profiting handsomely, others are left holding the bag, especially when considering the high gas fees associated with trading Ethervista. The idea that someone is playing the game so effectively while others are footing the bill has left a sour taste in many investors’ mouths.

The Ethervista saga also highlights the broader issue of transparency and fairness in the crypto market. The lack of regulation means that market manipulation can and does happen, and it’s often the small investors who suffer the most. As always in the crypto space, the mantra “Do Your Own Research” (DYOR) rings true. It’s essential to be informed and cautious when dealing with tokens that are showing unusual patterns of activity.

What’s Next for Ethervista?

As Ethervista continues to consume gas and VISTA’s trading activity remains in the spotlight, the future of these tokens is uncertain. Will Ethervista maintain its momentum, or will it burn out as quickly as it rose? Only time will tell.

For now, the crypto community will be watching closely to see how the situation unfolds. The story of Ethervista serves as a reminder of the unpredictable nature of the crypto market and the importance of staying informed and vigilant.

In summary, Ethervista’s rapid consumption of gas fees and the questionable activity surrounding VISTA’s largest holders have cast a shadow over what initially seemed like a promising project. While some are profiting, others are paying the price—literally. As always in the world of crypto, caution and research are key. The Ethervista story is far from over, and it will be interesting to see how it develops in the coming weeks.

FAQs

1. Why is Ethervista consuming so much gas?

Ethervista’s high gas consumption is due to the heavy transaction volume on the network. This could be a result of increased trading activity, particularly as investors move in and out of VISTA.

2. What’s the deal with VISTA’s largest holders?

The largest and third-largest VISTA wallets are controlled by the same entity. This individual has been buying and selling large amounts of VISTA, leading to suspicions of market manipulation.

3. Should I be concerned about investing in Ethervista or VISTA?

As with any investment, it’s important to do your own research and be aware of potential risks. The concentration of VISTA in a few wallets and Ethervista’s high gas fees are factors to consider before investing.