Advocating for Stablecoins: Why Stability Matters in a Volatile Crypto Market

In the ever-changing world of cryptocurrency, where prices can swing wildly within hours, stablecoins have emerged as a beacon of stability. These digital assets are designed to maintain a steady value, often pegged to a traditional currency like the U.S. dollar. While the broader crypto market is known for its volatility, these coins offer a reliable alternative, making them a crucial component in the evolving landscape of digital finance.

What Are Stablecoins?

Stablecoins are a type of cryptocurrency that aims to reduce price volatility by being pegged to a stable asset, such as a fiat currency (like the U.S. dollar), commodities (like gold), or even another cryptocurrency. This pegging mechanism ensures that the value of the stablecoin remains relatively constant, providing users with a sense of security in an otherwise unpredictable market.

There are several types of stablecoins, each with its own mechanism for maintaining stability:

- Fiat-Collateralized Stablecoins: These stablecoins are backed by reserves of fiat currency, held in a bank account. For every stablecoin issued, an equivalent amount of fiat currency is kept in reserve. Examples include Tether (USDT) and USD Coin (USDC).

- Crypto-Collateralized Stablecoins: These are backed by other cryptocurrencies, often over-collateralized to account for the volatility of the underlying assets. Dai (DAI) is a prominent example, which is backed by a mix of cryptocurrencies like Ethereum.

- Algorithmic Stablecoins: Unlike collateralized stablecoins, algorithmic stablecoins use smart contracts to automatically adjust the supply of the coin to maintain its value. An example is TerraUSD (UST), though it has faced challenges in maintaining its peg.

Why Stability Matters in the Crypto Market

The crypto market is notoriously volatile, with prices of assets like Bitcoin and Ethereum experiencing significant fluctuations. While this volatility can lead to substantial gains, it also poses risks, especially for those looking to use cryptocurrency for everyday transactions, savings, or as a store of value.

This is where stablecoins come into play. By offering a stable value, they provide several key benefits:

- Safe Haven for Investors: During times of market turbulence, investors often seek refuge in stable assets. Stablecoins offer a way to preserve value without exiting the crypto ecosystem, allowing users to avoid the volatility of other cryptocurrencies.

- Facilitating Everyday Transactions: For cryptocurrencies to be widely adopted as a means of payment, they need to have a stable value. Stablecoins enable users to make everyday transactions without worrying about price fluctuations, making them more practical for real-world use.

- Bridging Traditional Finance and Crypto: Stablecoins act as a bridge between traditional financial systems and the world of cryptocurrency. They allow for seamless conversions between fiat currency and digital assets, making it easier for new users to enter the crypto market.

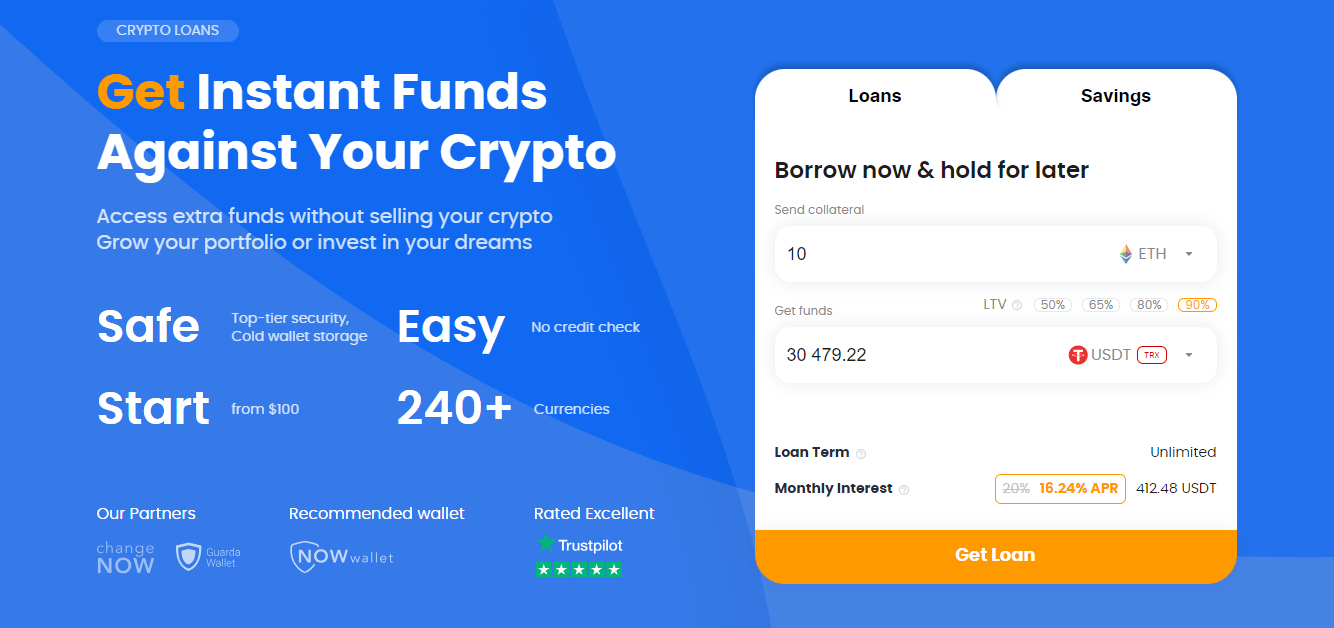

- Enabling DeFi Applications: Decentralized finance (DeFi) platforms rely heavily on stablecoins to function. These coins provide liquidity and stability in various DeFi protocols, such as lending, borrowing, and trading, making the ecosystem more robust and accessible.

The Role of Stablecoins in Financial Inclusion

Stablecoins have the potential to play a significant role in promoting financial inclusion, especially in regions with unstable currencies or limited access to traditional banking services. By providing a stable and accessible digital currency, stablecoins can help people protect their wealth, make international payments, and participate in the global economy.

For example, in countries experiencing hyperinflation, residents may turn to stablecoins as a more reliable store of value compared to their national currency. Additionally, stablecoins can facilitate cross-border remittances, offering a faster and cheaper alternative to traditional remittance services.

The Future of Stablecoins

The future of stablecoins looks promising, especially as the crypto market continues to mature and integrate with traditional finance. Innovations in stablecoin design, improved regulatory clarity, and increased adoption could help address current challenges and unlock new opportunities.

As central banks around the world explore the development of their own digital currencies (CBDCs), stablecoins could play a complementary role, offering a bridge between decentralized cryptocurrencies and state-backed digital currencies.

Moreover, the growing popularity of decentralized finance (DeFi) and Web3 applications will likely increase the demand for stablecoins, as they provide the necessary stability and liquidity for these platforms to thrive.